TOP TIPS FOR BUYING A HOME

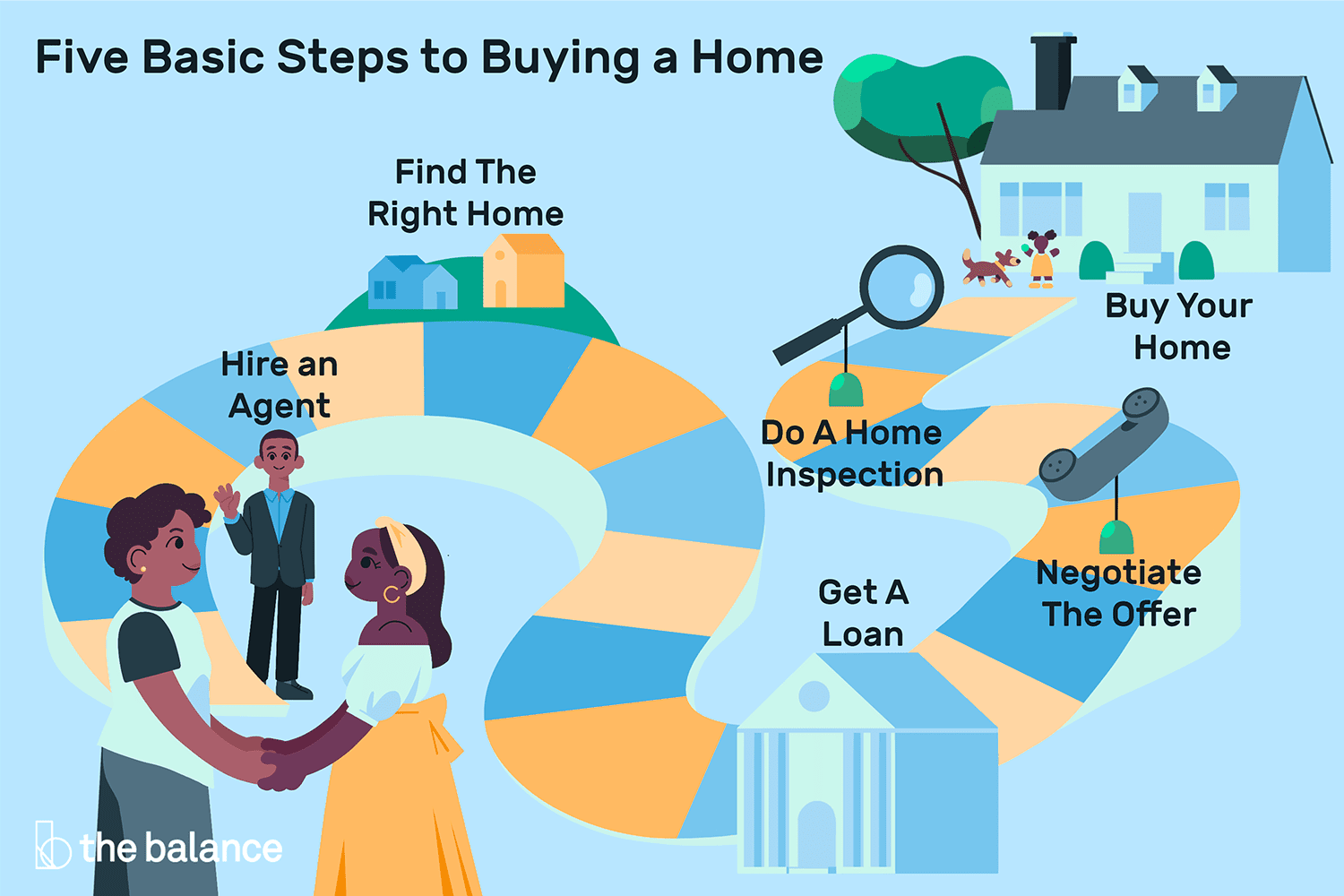

Buying a home is one of the biggest decisions you will ever make in life. It’s not only a major financial commitment, but it is also a decision that will affect your lifestyle and quality of life for the years to come. To ensure you make the right decision, here are some top tips to help you make the best purchase.

- Have a clear budget: Set a budget before you start your search and stick to it. Consider all associated costs, such as insurance, taxes, and repairs so you don’t end up in a financial bind.

- Research the area: Get to know the area you are interested in and make sure it meets your needs. Research schools, crime rates, and local amenities.

- Get a home inspection: Have a professional home inspector check the property for any hidden defects. This will help you to avoid any future costly repairs.

- Have your finances in order: Make sure you have a good credit score and have saved enough for a down payment. Get pre-approved for a loan to ensure you can afford the home you want.

- Negotiate: Don’t be afraid to negotiate the price and terms of the sale. You might be able to get a better deal than what is first offered.

By following these steps, you can ensure that you are making the best decision when buying a home. Investing in a home is a big decision, so take your time and do your research. Good luck!

Establishing a Budget

Establishing a budget before you start house hunting is important. It’s not only a way to ensure that you don’t overspend, but it’s also a way to take a realistic look at what kind of house you can afford. To begin, figure out what your monthly expenses are, such as debt payments, utilities, groceries, and other necessary spending. Subtract this from your monthly income, and you’ll get an idea of how much you can reasonably spend on a mortgage. It’s also a good idea to calculate other costs associated with buying a home, such as closing costs, inspection fees, and repairs. Once you have a clear picture of your financial situation, you can begin to shop for a home that fits your budget and lifestyle.

Investigating Different Loan Options

When it comes to buying a home, one of the most important things to consider is how you will finance it. Before you start house hunting, it is essential to understand the different loan options that are available to you. The type of loan you choose will impact your monthly payments, the amount of interest you will pay over the life of the loan, and other important factors. With so many loan options out there, it can be difficult to know where to start. Here are some tips to help you investigate different loan options and find the right loan for you.

Start by researching the types of loans that are available. There are a variety of loan options, such as conventional, FHA, VA, and USDA loans. Each type of loan has its own set of requirements and benefits, so it is important to understand the differences between them. You should also research the types of lenders you can work with, such as banks, credit unions, and online lenders.

It is also important to consider the terms of the loan. Look at the interest rate, loan term, and other factors to determine which loan is best for you. You should also consider the fees associated with the loan. Fees may include origination fees, closing costs, and prepaid items.

Finally, you should consider your credit score and how it may affect your loan. Your credit score will determine the type of loan you qualify for and the interest rate you will be offered. It is important to check your credit score before you apply for a loan to ensure that you are getting the best rate possible.

By researching different loan types, lenders, terms, and fees, you can determine the best loan option for you and your financial situation. With the right loan, you can finance your dream home and start building your future.

Working With a Real Estate Agent

When it comes to buying a home, having the right guidance and support can make all the difference. A real estate agent can provide invaluable advice when it comes to navigating the buying process. They can help you hone in on the right property for you, as well as provide the tools and resources you need to make an informed decision. Working with an experienced agent can also help you stay within budget, negotiate the best deal, and ensure that the process runs as smoothly as possible. That said, it’s important to find a real estate agent that you feel comfortable with and who has your best interests in mind. Do your research, ask around, and make sure that the agent you choose is reputable, knowledgeable, and experienced. A good real estate agent can be an invaluable asset when it comes to making one of the biggest decisions of your life.

Home Inspections

Buying a home is a major investment and an exciting milestone for many. Before making an offer, it is important to conduct a thorough home inspection. A home inspection is a visual examination of the condition of the house that is conducted by a licensed professional inspector. Home inspections help to identify potential problems and issues with the home before the purchase is complete.

During a home inspection, the inspector will look at the structure, foundation, roof, electrical, plumbing, and HVAC system, and more. The inspector will also check for safety hazards, such as mold, asbestos, or lead paint. The inspection will also include an analysis of the condition of the appliances, such as the furnace, water heater, and air conditioner.

When the inspection is complete, the inspector will provide an inspection report detailing any issues they identified and any recommendations for repairs or replacements. It is important to review the report carefully and ask questions if you have any. If any major issues are found, you may be able to renegotiate the purchase price or ask the seller to make repairs.

Home inspections are an important part of the home-buying process and can help to ensure that you make an informed decision. Be sure to take the time to find a qualified professional inspector and to review the inspection report carefully.

Negotiating a Purchase Agreement

Purchasing a home is one of the biggest financial decisions you’ll ever make, and it can be intimidating. Because of this, it’s important to understand the negotiating process when it comes to buying a home. The purchase agreement you sign will outline the terms of your purchase, including the price, the closing date, and any conditions that must be met before the sale is finalized. To ensure that you get the best deal possible, here are some tips for negotiating a purchase agreement.

First, do your research. Research the local area, the price of comparable homes, and the condition of the property you are interested in. This information will help you determine the fair market value of the home, which will inform your negotiation strategy.

Second, be prepared to negotiate. During the negotiation process, be ready to make counteroffers, ask questions, and discuss any concerns you have with the purchase agreement. Remember, the seller is likely looking for the highest price they can get, so you may need to negotiate to get the best deal.

Third, use the right tools. Use online calculators to ensure that you are getting a fair deal on your purchase, and enlist the help of an experienced real estate agent to assist you in the negotiation process.

Finally, be patient. Purchasing a home can be a lengthy process, and it’s important to remain patient and level-headed throughout the negotiation process. By following these tips, you can be sure to get the best deal possible when buying a home.

Finalizing the Purchase

Making a home purchase is a big step, and the finalization process can seem intimidating. But if you’ve done your research and taken the time to explore your options, the actual process of purchasing a home should go smoothly. Here are some tips to help you make the most out of your home-buying experience:

Know Your Budget: Before you start looking for homes, make sure you understand your budget. Be sure to factor in any additional costs, such as closing costs, taxes, and insurance. This will help you narrow down your search and make sure you don’t end up spending more than you can afford.

Hire a Professional: A real estate agent can be a great asset when it comes to purchasing a home. They understand the market and can help you find the right home at the right price. They can also provide valuable advice about things like local laws, taxes, and other important details.

Understand the Closing Process: Once you’ve made an offer and it has been accepted, the closing process will begin. This process can take several weeks, so it’s important to understand all the steps and be prepared for any delays.

Be Patient: Buying a home is a big investment, so it’s important to take your time and make sure you’re making the right choice. Don’t rush into a decision just to get it done. Instead, take your time and be sure to weigh all your options carefully.

By following these tips, you can ensure that the process of buying a home goes as smoothly as possible. With a little patience and the right guidance, you can find the perfect home for you and your family.

Home Insurance

Whether you’re a first-time homebuyer or a seasoned veteran, securing the right home insurance policy is essential to protect your investment. Home insurance covers you for losses caused by fires, theft, storms, or other events, and most policies also provide liability coverage in the event someone is injured while visiting your home. To find the best coverage for your needs, here are some tips to consider:

- Shop around: Don’t settle for the first policy you find. It pays to compare multiple quotes from different providers to find the best coverage at the best price.

- Understand coverage: Make sure you know exactly what is and is not covered in the policy. If you’re unsure, ask questions or consult with an insurance agent.

- Consider your location: Where you live can have a big impact on the cost of your home insurance. Areas prone to natural disasters or crime may require higher premiums.

- Consider additional coverage: When selecting coverage, consider adding additional riders to cover items such as jewelry, fine art, and antiques.

- Review your policy annually: Home insurance policies can change over time. Make sure to review yours every year to make sure you still have the coverage you need.

By following these tips, you’ll be better equipped to purchase the right home insurance policy for you and your family.

Closing and Possession

Closing and Possession is the final step in the home buying process when homeowners officially take ownership of their home. To ensure a smooth transition, it’s important to be prepared with the necessary documents and funds. Homeowners should have their documents ready to sign and money in the bank to cover closing costs, which can range from 2-5% of the purchase price. It’s also important to coordinate a timeline with the seller and your real estate agent that works for both parties. This timeline should include the closing date, possession date, and other important dates regarding the transition of ownership. It’s also important to understand the associated costs to move in, such as utility setup fees, cleaning services, and more. Homeowners should make sure they are fully prepared for closing and possession, to ensure a successful and stress-free transition.

FAQs About the TOP TIPS FOR BUYING A HOME

Q1: What factors should I consider when buying a home?

A1: When buying a home, you should consider factors such as location, budget, resale value, and amenities. You should also consider whether the home needs repairs or renovations, as well as the taxes and insurance associated with the home.

Q2: What should I look for when viewing a potential home?

A2: When viewing a potential home, you should focus on the condition of the property and the features it offers. Consider the layout of the home and the quality of its construction. You should also take note of any potential structural issues, such as cracks in the walls or roof.

Q3: How much money should I set aside for closing costs?

A3: Closing costs can vary greatly, but typically range between 2 and 5% of the home’s purchase price. Generally, you should plan to set aside at least 3% of the home’s purchase price for closing costs.

Conclusion

Buying a home is a huge investment and can be a daunting process. It is important to be well-informed and to take the time to consider all the factors that go into making this important decision. Following the top tips for buying a home can help you make the best decision for your needs and provide you with the assurance that you have made the right choice. Researching the market, budgeting ahead of time, getting pre-approved for a mortgage, and enlisting the help of a real estate professional are all important steps to take when buying a home. With the right approach and the right guidance, you can be sure to find the perfect home for you.